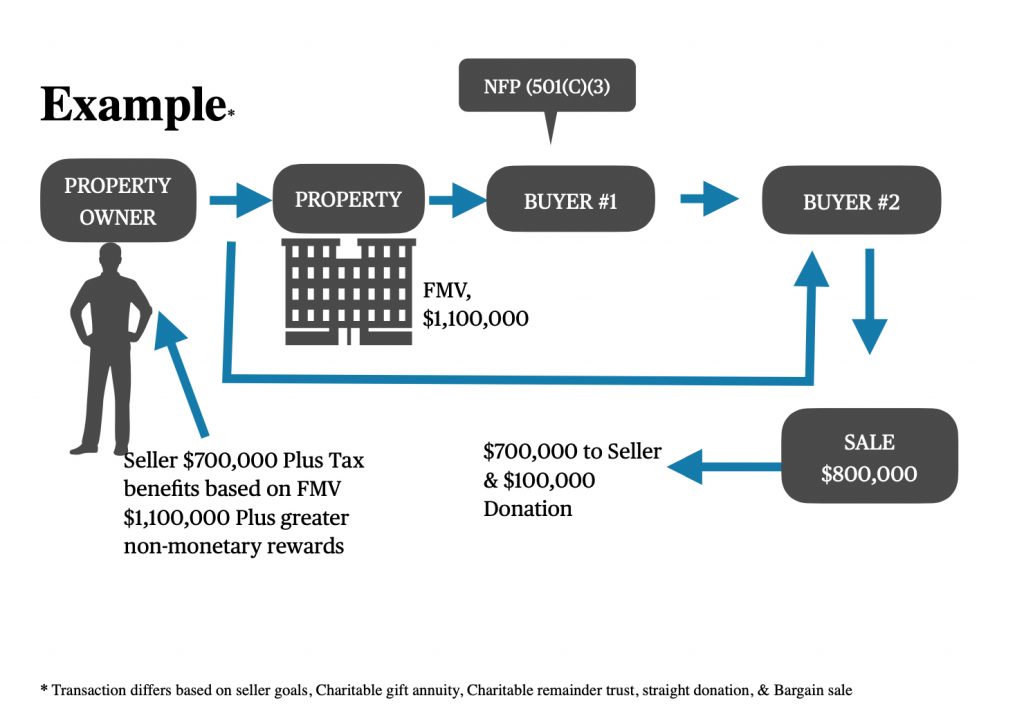

Exchange of benefits examples;

Property owner FAQs

What is Fair Market Value FMV?The IRS defines Fair Market Value as “the price that would be agreed on between a willing buyer and a willing seller, with neither being required to act, and both having reasonable knowledge of the relevant facts” for IRC 170 FMV is determined by an MAI appraisal not based on the sale price. Selling a property to a 501(c)(3) nonprofit through a Section 170 transaction, the property owner gets to value the property at its highest and best use, not the current lower value. The valuation should be done by a certified appraiser with the MAI designation. It is then sold to the nonprofit at the highest and best use appraisal. The seller receives a minority portion of this value in cash at closing and the remainder is received as tax deductions and rebates from the state and federal governments

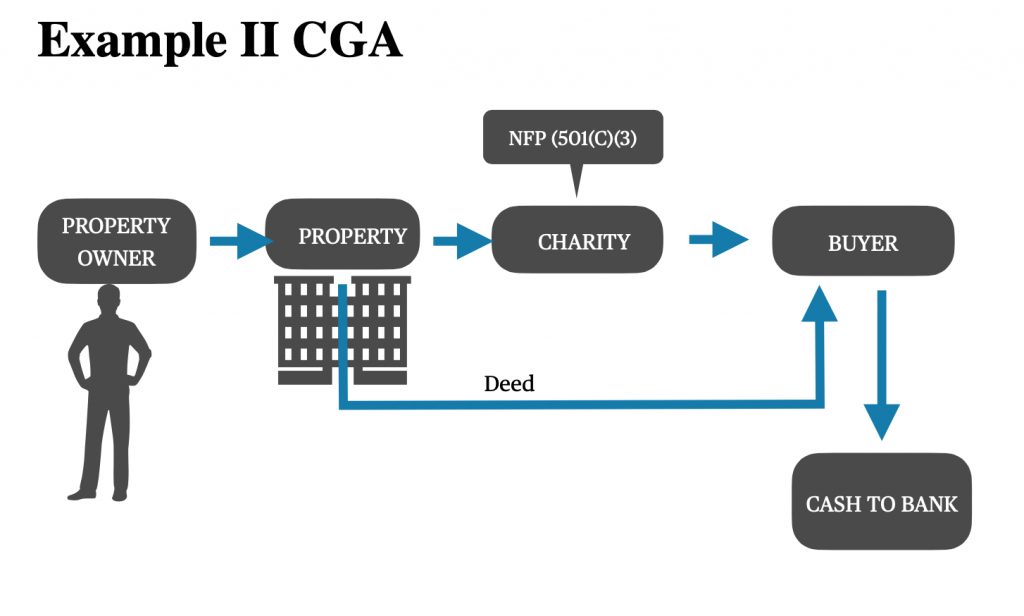

What is a IRC 170?

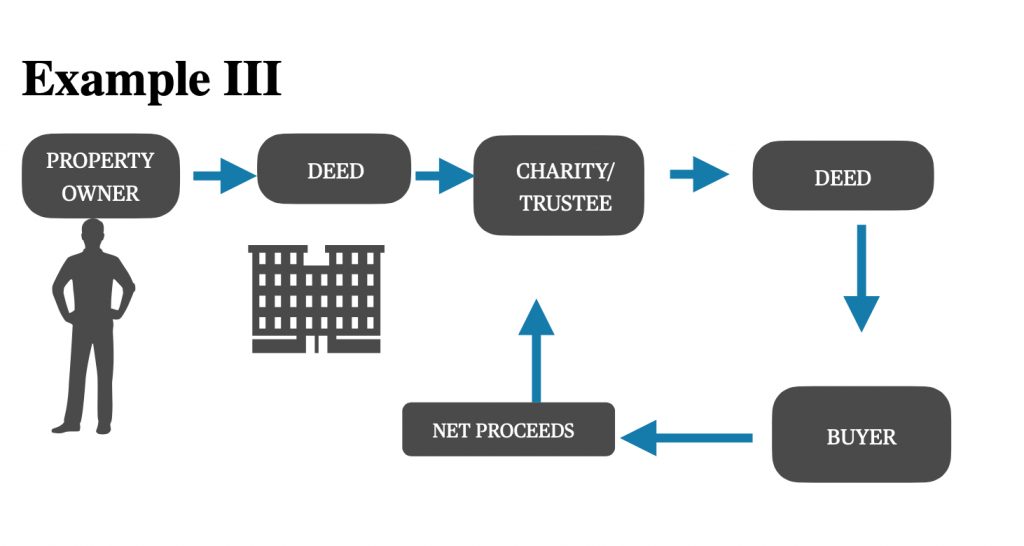

The sale of an asset to a charity at less than fair market value. It’s a combination of cash at closing from a buyer, plus cash in the form of tax reduction or rebate from Federal and State governments. Depending on the Seller’s tax liability, it’s not uncommon to get the full tax benefit in as little as 30 days, but the Seller has up to six years to fully utilize the deduction.

This transaction is regulated by the IRS Code Section 170 because it relates to charitable contributions of non-cash transactions. IRS Publication 526 and 561 are two additional IRS publication guidelines that further help explain the guidelines for this type of transaction.

With the IRS Section 170 Bargain Sale, the buyer is a tax exempt entity and the seller is desiring to (will) receive a tax deduction on a portion of the transaction. Therefore, special rules apply to this transaction. Some of the unique transactions features are the following:

– The buyer must be a qualified tax exempt nonprofit.

– The seller must obtain a qualified appraisal.

– The seller may deduct the difference of the appraised value and the cash amount received, as a charitable contribution. This charitable contribution tax deduction is like any other cash charitable contribution.

– The difference is that it’s not cash and therefore requires some sort of valuation mechanism defined by the IRS for charitable contribution purpose. The method valuing the specific assets are further defined in IRS Publication 561.

– Both buyer, seller, and appraiser must sign IRS Form 8283 and seller must submit this form with seller’s tax return.

In order to qualify for the Federal and State tax benefits, the Seller must have sufficient taxable income to utilize the charitable portion of the transaction. The Seller is entitled to write off up to 60% of their annual Adjusted Gross Income (AGI) for charitable purposes.

When it comes to real estate however, there is a caveat. The Seller can deduct up to 50% of their annual AGI only if they use their cost basis for the property (what they paid for it). In the vast majority of cases however, it may be in the Sellers best interest to accept the 30% ceiling for allowable charitable tax deductions in a given year, and use the current Fair Market value of the property based on an independent, certified appraisal.

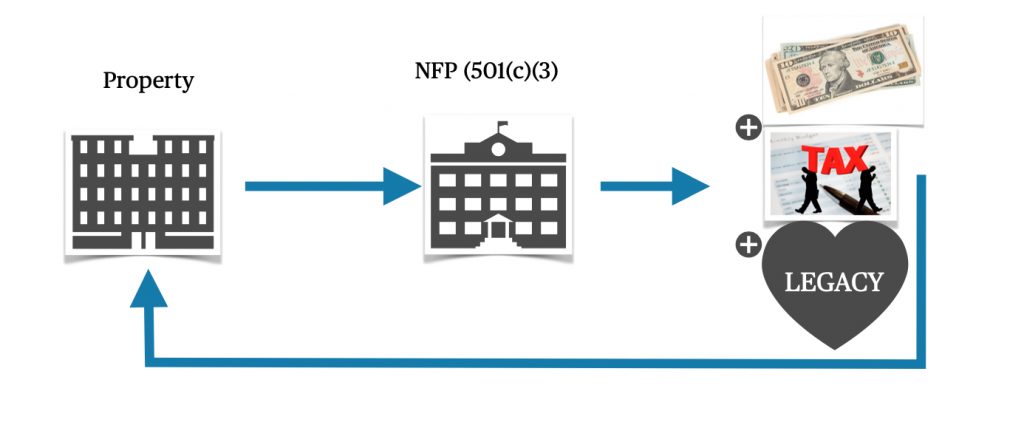

Seller Key Benefits:

- The seller receives a substantial amount of cash at closing.

- The seller receives a substantial charitable deduction for the remainder of the full and true, fair market value.

- The seller enjoys the satisfaction of being able to help others.

When do you consider the IRS Section 170 transaction?

- The seller have a large tax liability.

- The seller ready to cash out of a 1031 Exchange.

- The property in a secondary or tertiary market.

- The property sell easier if it was for a new/different use

IRC 170 Transaction Rules:

- The buyer must be a federally recognized 501(c)(3) entity.

- A dedicated MAI designated appraiser must evaluate the property.

- An IRS 561 independent appraisal must take place within 60 days of the transaction.

- Appraisal paid by the seller

- Seller must have enough taxable income to qualify for this type of deduction.

Here’s an explanation of how the numbers work:

An MAI appraisal determined the property FMV $2,000,000, the owner basis in the asset (B) $300,000, and the selling price (SP) $1,800,000.

The bargain element in the sale, for which the donor-seller may claim a charitable deduction, is FMV – SP.

The gain realized by the donor-seller is given by this formula:

Gain realized = (SP/FMV) x (FMV – B)

Example: Assume FMV = $2,000,000; B = $300,000; and SP = $1,800,000. Donor-seller may claim a federal income tax charitable deduction (subject to all the usual limitations and valuation requirements) of $2,000,000 – $1,800,000, or $200,000.

Donor-seller realizes a gain equal to:

($200,000/$2,000,000) x ($2,000,000 – $300,000)

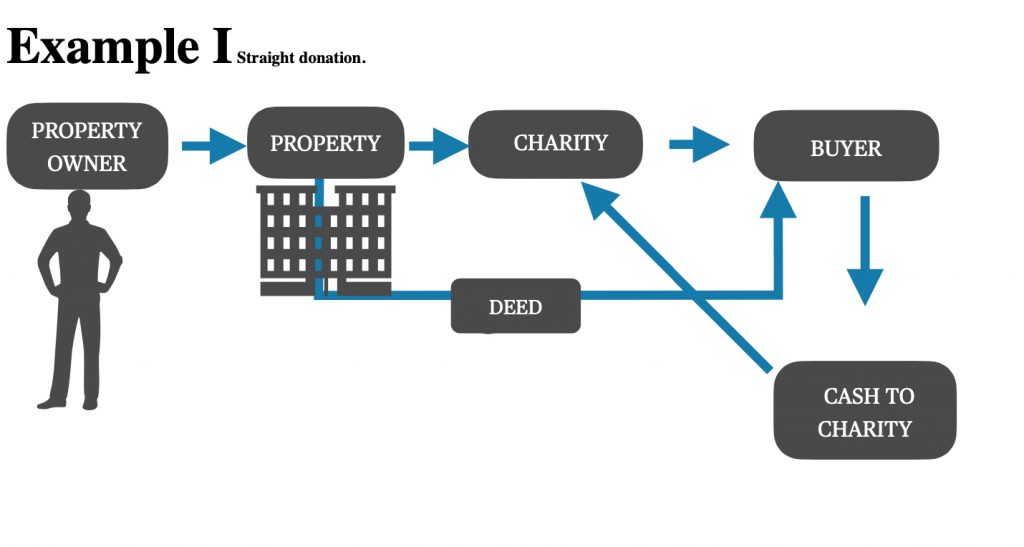

How this is different from donation?

Unlike a standard donation, the IRS Section 170 Bargain Sale is a combination of cash from the Buyer at closing and a cash benefit derived from tax savings in the form of reduction or rebate, depending on the Sellers specific tax liability. It is defined in IRC 170 of the IRS code as a “Bargain Sale”, because it is in fact, a sale, but has a charitable component to it.

A straight donation has no cash component and is often not valued for its full and fair market value due to the Seller either not being informed about IRS approved valuation guidelines or not caring enough about the deduction.

In short, the IRS Section 170 Bargain Sale delivers the best of both worlds to a Seller. They typically get cash at closing or possibly the assumption of debt, PLUS they get a valuable tax deduction to reduce or eliminate other tax liabilities.

What is the different between 1031 Exchange and IRC 170?

The 1031 Exchange is an excellent vehicle to build up wealth in a tax free environment. However, when you want to cash in your 1031 Exchange, the total accumulated profits become taxable. That’s because the 1031 Exchange is a tax deferment vehicle while the IRS Section 170 Bargain Sale is a tax reduction strategy.

With the Bargain Sale, the Seller can enjoy immediate cash at closing, PLUS an immediate tax deduction that in many cases can significantly reduce taxes due by the Seller. In short, the IRS Section 170 Bargain Sale eliminates taxes, while the 1031 Exchange merely delays taxes which may have to be paid at an even higher rate in the future, depending on prevailing tax law at the time.

Can I use IRC 170 to cash 1031 Exchange?

When you cash out of your 1031 Exchange, there is typically a big tax bill due. You can offset some or all of that tax liability with IRS Section 170 Bargain Sale which in effect, absorbs the brunt of the tax liability with the charitable portion of IRS Section 170 Bargain Sale.

You can accomplish this a couple ways…

– Sell the property coming out of the 1031 Exchange using IRS Section 170 Bargain Sale. This assures that the bulk of the funds you ultimately receive will be tax free. It also greatly reduces taxes due on the cash portion of the transaction.

– If you have already been cashed out of your 1031 Exchange and are facing a big tax bill, you can do IRS Section 170 Bargain Sale on a different piece of property and use those tax savings to offset some or all of your gains from the 1031 Exchange.

The amount of tax reduction is dependent on your tax liability, income and other factors. If you have a specific property in mind, give us a call and we’ll most likely be able to match it up with one of our buyers and get an offer back to you fairly quickly.

Why should I used your service?

The 1031 Exchange is an excellent vehicle to build up wealth in a tax free environment. However, when you want to cash in your 1031 Exchange, the total accumulated profits become taxable. That’s because the 1031 Exchange is a tax deferment vehicle while the IRS Section 170 Bargain Sale is a tax reduction strategy.

With the Bargain Sale, the Seller can enjoy immediate cash at closing, PLUS an immediate tax deduction that in many cases can significantly reduce taxes due by the Seller. In short, the IRS Section 170 Bargain Sale eliminates taxes, while the 1031 Exchange merely delays taxes which may have to be paid at an even higher rate in the future, depending on prevailing tax law at the time.

It is not a cookie-cutter deal each side has his own concerns.

Charities:

As with other transactions involving real estate there are many legal fees associated with accepting a donation of real estate, such as environmental clean-up or legal liabilities.

Charities must ensure that a donated property has enough equity that potentially high legal costs will not significantly reduce the benefit received from the donation.

Resources Required to Manage the Property.

Potential Concerns in Accepting Donations of Real Estate Costs.

If charity plans to keep the donated property, it should have adequate resources to maintain the property.

This type of resource allocation may prove difficult for a charity with limited resources. Adding more responsibilities for a small staff may dilute their ability to achieve the charity’s primary mission and objectives.

Unrelated Business Taxable Income (UBTI)

UBTI is taxable income derived from activities that don’t align with your charity’s mission.

To avoid UBTI, it’s important that you don’t use property to generate income if the resulting income doesn’t align with your goals and mission. Such income is taxable.

For example, collecting rent from tenants in a donated commercial building that falls outside of your charity’s mission will be subject to tax as UBTI.

Does the charity have to have a related use for the property?

Real Estate is Different, Related Use rules apply to tangible personal property which is defined by the IRS in Publication 526 (page 10, column 1) as “any property, other than land or buildings, that can be seen or touched. It includes furniture, books, jewelry, paintings, and cars.” Real estate on the other hand, is defined by the IRS as “capital gain property if you would have recognized long-term capital gain had you sold it at fair market value on the date of contribution. Capital gain property includes capital assets held more than 1 year.” It is not subject to the same “related use” rules that “tangible personal property” is.

When figuring your deduction for a contribution of capital gain property, you generally can use the fair market value of the property. However, in certain situations, you must reduce the fair market value by any amount that would have been long-term capital gain if you had sold the property for its fair market value. Generally, this means reducing the fair market value to the property’s cost or other basis. You must do this if:

- The property (other than qualified appreciated stock) is contributed to certain private non-operating foundations, (not applicable with our clients)

- You choose the 50% limit instead of the special 30% limit for capital gain property, (not recommend in most cases)

- The contributed property is intellectual property (not applicable with our offers),

- The contributed property is certain taxidermy property (not applicable with our offers), or

- The contributed property is tangible personal property and is either put to an unrelated use or has a claimed value of more than $5,000 and is sold, traded, or other-wise disposed of by the qualified organization during the year in which you made the contribution, and the qualified organization has not made the required certification of exempt use (such as on Form 8282, Donee Information Return, Part IV). (Real estate is not considered tangible personal property, so this is not applicable)

FAQs Appraisal:

It is recommend to use appraisers who are familiar with Section 170 of the IRS code as it pertains to valuations. Many of the basic guidelines are outlined in IRS Publication 561.

Appraisals for Bargain Sales are determined by IRS Publication 561 guidelines and are different than other appraisal methods. These guidelines were established to assure the full and fair market value of any real estate property. The IRS defines Fair Market Value as “the price that would be agreed on between a willing buyer and a willing seller, with neither being required to act, and both having reasonable knowledge of the relevant facts”. Therefore, distressed sales comparable do not qualify under this scenario. Furthermore, the proper marketing time required to dispose of an asset is determined by the appraiser considering the type, size, and location of the asset. Qualified appraisers often determine that some assets require over three years to liquidate and find the right suitable buyer.

The IRS further recognizes that unlike uniformly minted gold coins for example, all real estate is considered to be non-fungible. In other words, no two properties are the same and each property can and should be valued according to its unique characteristics.

A standard bank valuation for loan purposes leans toward the conservative side to limit their exposure (e.g. liquidation scenario), while an insurance appraisal tends to be the highest due to having to factor in replacement costs. With an IRS Section 170 Bargain Sale valuation, there are five major guidelines that are factored together to achieve the full and fair market value, generally resulting in an appraised value that falls somewhere between a conservative bank appraisal and a replacement cost valuation for insurance purposes depending on the type and location of the asset.

- Fair Market Value: Fair Market Value is greatly affected by the law of supply and demand. Greater demand usually means a higher valuation. Yet many property resellers spend the minimal amount on marketing to create demand and their advertising often fails to communicate a property’s full value. IRS valuation rules assume a reasonable marketing budget, that expertly conveys the full and fair market value of a property, which tends to stimulate more demand and potentially, higher valuation. Furthermore, marketing time period is another important factor as stated above.

- Highest and Best Use: When determining fair market value for an IRS Section 170 Bargain Sale, the appraiser may factor in highest and best use. So for example, if zoning allows, an old warehouse could be valued as office condos or a commercial restaurant such as with the popular Old Spaghetti Factory chain. Another example: If valued as a package, three homes clustered together in the old town center, may bring a higher valuation than the total of their separate valuations, especially if the highest and best use could be for a CVS or Walgreens.

- Comparable Sales Method: The comparable sales method compares the subject property with several similar sold properties. Whereas banks typically only want sold comps from the last six months, finding a sold comp for a large industrial property may require a much broader look back in history, along with a broader geographic search area, resulting in a more accurate and potentially higher valuation. Distressed sales assume the seller was under compulsion to sell, and therefore are disqualified or adjusted upwards to account for the distressed sale nature as determined by the appraiser in each individual case.

- Capitalization of Income: This method capitalizes the net income from the property at a rate representing a fair return on investment at the current time, considering the risks involved. Often the capitalization of income value approach is higher because it accounts for the discrepancy of market rate rents vs. available inventory for sale, as well as the opportunity of utilizing the asset as an investment property after being fully developed as an investment property.

- Replacement Cost Minus Observed Depreciation: Replacement cost is figured by considering the materials, labor, overhead, quality of workmanship, building size and profit. With historical properties, reproduction costs may be used instead of replacement costs and result in higher valuation. Valuation is then adjusted to allow for the current condition and remaining useful life of the structure.

The combination of these and other factors and others, which is accounted for in the final value of the 561 Appraisal, may result in a higher valuation than what the Seller is willing to accept in a quick sale to get out of high carrying costs and escape the nuisance factor of owning a vacant building.

FAQs Broker:

Charitable Contribution Deductions

Temporary Increase in Limits on Contributions of Food Inventory

There is a special rule allowing enhanced deductions by businesses for contributions of food inventory for the care of the ill, needy or infants. The amount of charitable contributions of food inventory a business taxpayer can deduct under this rule is limited to a percentage (usually 15 percent) of the taxpayer’s aggregate net income or taxable income. For contributions of food inventory in 2020, business taxpayers may deduct qualified contributions of up to 25 percent of their aggregate net income from all trades or businesses from which the contributions were made or up to 25 percent of their taxable income.

The Coronavirus Tax Relief and Economic Impact Payments page provides information about tax help for taxpayers, businesses, tax-exempt organizations and others – including health plans – affected by coronavirus (COVID-19).

This article generally explains the rules covering income tax deductions for charitable contributions by individuals. You can find a more comprehensive discussion of these rules in Publication 526, Charitable Contributions PDF, and Publication 561, Determining the Value of Donated Property PDF. For information about the substantiation and disclosure requirements for charitable contributions, see Publication 1771 PDF. You can obtain these publications free of charge by calling 800-829-3676.

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases. Tax Exempt Organization Search uses deductibility status codes to identify these limitations.

Qualified Organizations

You may deduct a charitable contribution made to, or for the use of, any of the following organizations that otherwise are qualified under section 170(c) of the Internal Revenue Code:

- A state or United States possession (or political subdivision thereof), or the United States or the District of Columbia, if made exclusively for public purposes;

- A community chest, corporation, trust, fund, or foundation, organized or created in the United States or its possessions, or under the laws of the United States, any state, the District of Columbia or any possession of the United States, and organized and operated exclusively for charitable, religious, educational, scientific, or literary purposes, or for the prevention of cruelty to children or animals;

- A church, synagogue, or other religious organization;

- A war veterans’ organization or its post, auxiliary, trust, or foundation organized in the United States or its possessions;

- A nonprofit volunteer fire company;

- A civil defense organization created under federal, state, or local law (this includes unreimbursed expenses of civil defense volunteers that are directly connected with and solely attributable to their volunteer services);

- A domestic fraternal society, operating under the lodge system, but only if the contribution is to be used exclusively for charitable purposes;

- A nonprofit cemetery company if the funds are irrevocably dedicated to the perpetual care of the cemetery as a whole and not a particular lot or mausoleum crypt.

Timing of Contributions

Contributions must actually be paid in cash or other property before the close of your tax year to be deductible, whether you use the cash or accrual method.

Deductible Amounts

If you donate property other than cash to a qualified organization, you may generally deduct the fair market value of the property. If the property has appreciated in value, however, some adjustments may have to be made.

The rules relating to how to determine fair market value are discussed in Publication 561, Determining the Value of Donated Property PDF.

Limitations on Deductions

In general, contributions to charitable organizations may be deducted up to 50 percent of adjusted gross income computed without regard to net operating loss carrybacks. Contributions to certain private foundations, veterans organizations, fraternal societies, and cemetery organizations are limited to 30 percent adjusted gross income (computed without regard to net operating loss carrybacks), however. Tax Exempt Organization Search uses deductibility status codes to indicate these limitations.

The 50 percent limitation applies to (1) all public charities (code PC), (2) all private operating foundations (code POF), (3) certain private foundations that distribute the contributions they receive to public charities and private operating foundations within 2-1/2 months following the year of receipt, and (4) certain private foundations the contributions to which are pooled in a common fund and the income and corpus of which are paid to public charities.

The 30 percent limitation applies to private foundations (code PF), other than those previously mentioned that qualify for a 50 percent limitation, and to other organizations described in section 170(c) that do not qualify for the 50 percent limitation, such as domestic fraternal societies (code LODGE).

A special limitation applies to certain gifts of long-term capital gain property. A discussion of that special limitation may be found in Publication 526, Charitable Contributions PDF.

Foreign Organizations

The organizations listed in Tax Exempt Organization Search with foreign addresses are generally not foreign organizations but are domestically formed organizations carrying on activities in foreign countries. These organizations are treated the same as any other domestic organization with regard to deductibility limitations.

Certain organizations with Canadian addresses listed may be foreign organizations to which contributions are deductible only because of tax treaty. Besides being subject to the overall limits applicable to all your charitable contributions under U.S. tax law, your charitable contributions to Canadian organizations are subject to the U.S. percentage limits on charitable contributions, applied to your Canadian source income. A deduction for a contribution to a Canadian organization is not allowed if the contributor reports no taxable income from Canadian sources on the United States income tax return, as described in Publication 597 PDF.

Except as indicated above, contributions to a foreign organization are not deductible.

Reliance on Tax Exempt Organization Search

Revenue Procedure 2011-33, 2011-25 I.R.B. 887 describes the extent to which grantors and contributors may rely on the listing of an organization in electronic Publication 78 and the IRS Business Master File extract) in determining the deductibility of contributions to such organization. Grantors and contributors may continue to rely on the Pub.78 data contained in Tax Exempt Organization Search to the same extent provided for in Revenue Procedure 2011-33.

Similar reliance provisions apply to an organization’s foundation classification as it appears in the list. See also Revenue Procedure 89-23 PDF.

Deductions for Charitable Contributions IRC 170

The following article is courtesy of upconsel.com

One of the benefits of supporting a worthwhile cause is the ability to take a federal income tax deduction in some cases. To help contributors to nonprofit organizations understand which of their donations are tax deductible and which are not, the Council of Better Business Bureaus offers the following tips:

Tax Exempt vs. Tax Deductible

“Tax exempt” does not necessarily mean “tax deductible.” A tax-exempt organization is one that does not have to pay income taxes. Contributions made to certain tax-exempt organizations may be deductible on the donor’s federal income tax return. While the Internal Revenue Service (IRS) defines more than twenty different categories of tax-exempt organizations, contributions to groups in only a few of these categories are tax deductible.

You can determine the tax-exempt status of an organization either by contacting the local office of the IRS, or by asking the organization for a copy of its “Letter of Determination.” A “Letter of Determination” is the formal notification an organization receives from the IRS once its tax-exempt status has been approved. Also, IRS Publication 78, Cumulative List of Organizations, is an annual listing of thousands of tax-exempt organizations to which contributions are deductible as charitable donations as defined in section 170 of the Internal Revenue Code.

Organizations that Solicit Donations

Organizations that solicit contributions and memberships generally fall into one of the following four tax-exempt categories: 501(c)(3), 501(c)(4) 501(c)(6), and 501(c)(19). These numbers correspond to the sections of the Internal Revenue Code that describe these organizations.

501(c)(3)

To obtain a 501(c)(3) tax-exempt status, most nonprofit organizations must file documents with the IRS that prove them to be operated for certain charitable purposes specified by statute. (Older charities may have a 101(6) ruling, which corresponds to section 501(c)(3) of the current Internal Revenue Code.) Churches and small charities with less than $5,000 annual income do not have to apply to the IRS for recognition of exemption.

Organizations in the 501(c)(3) category include groups whose purposes are:

* Charitable

* Religious

* Scientific

* Educational

* Literary

* Preventing cruelty to children or animals

* Fostering national or international amateur sports competition

* Testing for public safety

Contributions to all 501(c)(3) organizations, except those that “test for public safety,” are deductible as charitable donations for federal income tax purposes.

Foundation Status

While its 501(c)(3) status determines that an organization is eligible to receive tax-deductible donations, its foundation status determines the limits of an individual donor’s deduction.

The three principal classifications of 501(c)(3) organizations are as follows:

A public charity (identified in IRS terms as “not a private foundation”) normally receives a substantial part of its income, directly or indirectly, from the general public or from the government. The public support must be fairly broad, not limited to a few individuals or families. Public charities are defined in the Internal Revenue Code under sections 509(a)(1) through 509(a)(4).

A private foundation, sometimes called a non-operating foundation, receives most of its income from investments and endowments. This income is used to make grants to other organizations, rather than being disbursed directly for charitable activities. Private foundations are defined in the Internal Revenue Code under section 509(a) as 501(c)(3) organizations which do not qualify as public charities. A private operating foundation is a private foundation that devotes most of its earnings and assets directly to the conduct of its tax-exempt purposes, rather than to making grants to other organizations for these purposes. Private operating foundations are defined in the Internal Revenue Code under section 4942(j)(3).

Deductibility Limitations to 501(c)(3) Groups

Individuals giving to 501(c)(3) organizations that are either public charities, private operating foundations, and certain private foundations may deduct contributions representing up to 50% of the donor’s adjusted gross income if the individual itemizes on his tax returns. The 1986 Tax Reform Act, which became effective January 1, 1987, does not allow non-itemizers to deduct charitable donations on their federal income tax returns. Individuals giving to 501(c)(3) organizations that are private foundations may generally deduct contributions representing up to 30% of their adjusted gross income. Corporations may deduct all contributions to 501(c)(3) organizations (regardless of foundation status) up to an amount normally equal to 10% of their taxable income.

501(c)(4)

Organizations that both perform a substantial amount of legislative lobbying on behalf of specific issues and primarily engage in social welfare activities may be classified under section 501(c)(4). Other organizations tax exempt under this section of the Internal Revenue Code include civic associations, some volunteer fire departments, and local associations of employees.

Contributions to 501(c)(4) organizations generally are not deductible as charitable donations, but they may be deductible as a business expense.

However, contributions to two types of 501(c)(4) organizations may be deductible as charitable donations:

* Volunteer fire companies and similar organizations, if the contributions are to be used for public purposes.

* Most war veterans’ organizations, if 90% of the organization’s membership is comprised of U.S. Armed Forces Veterans. Although a separate category-501(c)(19)-has been created for veterans’ organizations, some still have a 501(c)(4) ruling.

501(c)(6)

Non-profit organizations ruled tax-exempt under section 501(c)(6) of the Internal Revenue Code include business leagues, chambers of commerce, trade associations, real estate boards, and boards of trade. Contributions to 501(c)(6) organizations are not deductible as charitable donations for federal income tax purposes. Donations may be deducted as a business expense if they are “ordinary and necessary” in the conduct of the taxpayer’s business.

501(c)(19)

A separately created category for veterans’ organizations is the 501(c)(19) classification. Generally, contributions to 501(c)(19) organizations are deductible as charitable donations for federal income tax purposes if at least 90% of the members are war veterans. (Those veterans’ organizations that still have a 501(c)(4) ruling are also eligible to receive contributions deductible as charitable donations.)

Other Tax Deductible Contributions

In addition to the 501(c)(3), 501(c)(19), and the kinds of 501(c)(4) organizations previously named, the following classifications of tax-exempt groups are eligible to receive contributions deductible as charitable donations:

- Cooperative hospital associations-501(e).

- Cooperative service organizations of operating educational organizations-501(f).

- Nonprofit cemetery companies [501(c)(13)], if the contribution is given for care of the cemetery as a whole rather than for a particular plot.

- Domestic fraternal societies and associations [501(c)(10)] and fraternal beneficiary societies and associations [501(c)(8)], if the contributions are used for charitable [that is, 501(c)(3)] purposes.

- Corporations organized and tax-exempt under an Act of Congress, which serve as instrumentalities of the U.S.-501(c)(1). Examples include the Reconstruction Finance Corporation, Federal Reserve Banks, and Federal Credit Unions.

General Tips on Deducting Contributions

- Contributions are deductible for the year in which they are actually paid or delivered. Pledges are not deductible until the year in which they are paid.

- The value of volunteer time or services to a charitable organization is not deductible. However, out-of-pocket expenses directly related to voluntary service are usually deductible.

- Contributions for which the donor receives a gift or other kinds of benefits are deductible only to the extent that the donation exceeds the value of any benefit received by the donor.

- Direct contributions to needy individuals are not deductible. Contributions must be made to qualified organizations in order to be tax deductible.

- Contributions made directly to foreign organizations are not deductible, except in the case of some Canadian organizations as specified in an agreement with that country. Also, donations to charities located in Puerto Rico, the Virgin Islands, and other U.S. possessions are deductible. Such organizations must meet the requirements for exemption under the income tax laws of the United States.

- The “fair market value” of goods donated to a thrift store is deductible as long as the store is operated by a charity. To determine fair market value, visit a thrift store and check the “going rate” for comparable items. One cannot take a deduction if the goods are sold on a consignment basis whereby the original owner gets a percentage of the final sales price.

- Donated property may generally be deducted at the fair market value of the property at the time of the contribution. In certain situations, additional details concerning the property’s worth may need to be filed with the IRS in order to make a deduction on your federal income tax forms. Also, gifts of appreciated property are subject to special rules. See a financial advisor for additional details.

- PAS advises donors to seek professional advice or to consult the IRS when in doubt about the deductibility of contributions. The following IRS pamphlets, available through local IRS offices, also provide useful information.

Pub. 448: “Federal Estate and Gift Taxes”

Pub. 526: “Charitable Deductions”

Pub. 529: “Miscellaneous Deductions” (e.g., political contributions, labor union dues as an employee expense)

Pub. 535: “Business Expenses and Operating Losses”

Pub. 557: “Tax-Exempt Status for Your Organization”

Pub. 561: “Determining the Value of Donated Property”

Pub. 585: “Voluntary Tax Methods to Help Finance Political Campaigns”

Lobbying Restrictions for Tax-Exempt Organizations

As long as 501(c)(4), 501(c)(6), or 501(c)(19) organizations are primarily involved with tax-exempt activities, they can engage in a substantial amount of lobbying. However, lobbying may not be a substantial part of the activities of a 501(c)(3) organization. As noted by the IRS, if a contribution to a 501(c)(3) is earmarked for lobbying efforts, it is not deductible as a charitable donation. Permissible levels of lobbying expenditures are clearly specified for 501(c)(3) groups that elect to come under the alternative lobbying criteria of the Tax Reform Act of 1976.

When Goods and Services are Involved

A payment to a charity qualifies as a deductible gift only to the extent that it exceeds the fair market value of the privilege or benefit the “donor” receives in return for that gift. For example:

- One cannot deduct the full amount paid to a charity for such items as candy or magazines. If the charity charges $10 for a box of candy that normally sells for $8, only $2 can be claimed as a charitable contribution.

- The purchase price of tickets to a fundraising dinner, circus, or other meal or entertainment event is not fully deductible. Only the portion of the ticket price above the value of the meal or entertainment can be deducted for income tax purposes. The same rule applies even if, at the suggestion of the soliciting organization, the donor decides to let the charity give his or her tickets to underprivileged or disabled children. Likewise, even if the charity refers to the entire purchase price as a “donation,” the portion of the price that reflects the value of the admission is not deductible.

- Membership dues that merely cover the cost of privileges or benefits received by the “donor” are not deductible. However, “dues” that actually constitute a contribution for which the donor receives little or no privilege or benefit of monetary value in return are deductible.

The price of participating in a raffle or similar drawing cannot be deducted as a charitable donation.